What’s your most significant monthly expense? Did you say rent? Military members and their families typically change their duty station every two to three years. As a result, many rent a new house or apartment rather than purchase a home in every new state. Now you can earn points on your rent with the Bilt Rewards Program without any fees.

Bilt Rewards is a program that will reward you with transferable points each month just for paying your rent. The Bilt program is currently live and no longer requires a waitlist or invitation.

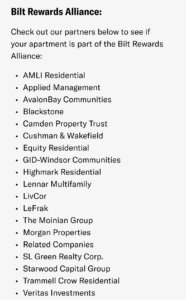

If you live in an active Bilt Rewards Alliance property; then, you can earn additional rewards through the program. See the picture for a list of properties currently in the alliance.

If you live in an active Bilt Rewards Alliance property; then, you can earn additional rewards through the program. See the picture for a list of properties currently in the alliance.

Suppose you already live within Bilt’s collection of preferred properties. In that case, you’ll earn points based on the rent amount, on-time payments, renewing your lease, and more. If you pay rent to a landlord outside the Bilt Rewards Alliance, you can still earn points with the Bilt Mastercard and pay through the designated app.

Bilt Rewards

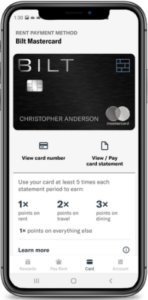

The Bilt Mastercard is a $0 annual fee credit card that will eliminate rent fees when paying through management companies’ online portals. Suppose the rental management company does not offer an online payment portal. In that case, you can also elect to have a check delivered via mail to the property manager’s address.

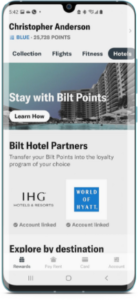

Presently, the points earned for paying your rent are transferable to 10 different travel partners at a 1:1 ratio. In addition, there are seven different airlines with at least one in each airline alliance and two hotel partners. Examples include American Airlines, World of Hyatt, United Airlines, Air Canada, and Emirates.

Presently, the points earned for paying your rent are transferable to 10 different travel partners at a 1:1 ratio. In addition, there are seven different airlines with at least one in each airline alliance and two hotel partners. Examples include American Airlines, World of Hyatt, United Airlines, Air Canada, and Emirates.

Most impressively, the Bilt Rewards program is the only rewards currency that will transfer to American Airlines AAdvantage miles. American Airlines has some great sweet spots for utilizing points and miles. Still, unless you fly them a lot or have a co-branded card, you had no easy way to collect miles until now.

Bilt Mastercard Earning Rates

The Bilt card earns:

The Bilt card earns:

-

- 1x points per $1 on all rent payments up to $50,000

- 2x points per $1 on travel purchases

- 3x points per $1 on dining purchases

The one caveat to the program is you will have to make at least five purchases on the credit card to earn any points during the monthly statement.

Other benefits include no foreign transaction fees up to $60 of Lyft credit per year when you take three rides per month. You’ll also receive trip cancellation insurance if a trip is canceled or interrupted up to $1,500 per incident and secondary rental car insurance for physical damage and theft of the rental car when you pay using your Bilt Mastercard.

Transfer Partners

Bilt has ten current partners who you can transfer points at a 1:1 ratio, including:

-

- American Airlines AAdvantage

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- Emirates Skywards

- Hawaiian Airlines HawaiianMiles

- IHG Rewards

- Turkish Airlines Miles&Smiles

- United MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

Some great uses of these partners are business class flights from the US to Asia, India, and the Middle East on American Airlines for only 70,000 miles. West Coast to Hawaii for only 20,000 miles on Hawaiian Airlines. Transcontinental business class seats on United using 12,500 Turkish miles. Or an all-inclusive stay in Mexico, Jamaica, or the Dominican Republic, courtesy of Hyatt, for only 25,000 a night.

Military Considerations

According to the Department of Defense, 63% of military members live in off-base private housing. In addition, most Americans spend anywhere from 30-40% of their monthly income on rent. In combination with the Bilt Mastercard, the Bilt Rewards program allows renters to pay their rent without fees and earn travel reward points.

According to the Department of Defense, 63% of military members live in off-base private housing. In addition, most Americans spend anywhere from 30-40% of their monthly income on rent. In combination with the Bilt Mastercard, the Bilt Rewards program allows renters to pay their rent without fees and earn travel reward points.

Amazingly, this card is a no-annual-fee card. As a result, this card should be on the radar of every renter in America, both civilian and military, looking for ways to cut the costs of expensive travel.

Bottom Line

The Bilt Rewards program is now open for everyone to sign up! All renters should sign up for this card. There is no downside of a no-annual-fee credit card in which you can earn travel reward points. Especially, if you live within their preferred network of residential communities, you should start earning immediately.

Lastly, the points you earn with transfer partners such as World of Hyatt and American Airlines can be highly lucrative. If you live near an American Airlines hub. This may be especially valuable as Bilt is the only program offering 1:1 transfers to American Airlines. Most Americans’ monthly income is spent on rent, and now there is a way to earn bonus points without a fee.

You must log in to post a comment. Log in now.